$4.99

Easily calculate your home office deduction with this all-in-one spreadsheet designed for solopreneurs and freelancers. Featuring both the Simplified Method and the Actual Cost Method, this tool streamlines calculations to ensure you’re maximizing deductions, saving time, and keeping accurate tax records.

The Home Office Deduction Calculator Spreadsheet is an essential tool for solopreneurs and freelancers looking to simplify their tax prep and maximize their home office deduction. This comprehensive spreadsheet offers two calculation methods: the Simplified Method and the Actual Cost Method, allowing you to choose the approach that best suits your unique situation.

With this Home Office Deduction Calculator, freelancers and solopreneurs can:

Ideal for self-employed individuals, this tool is a must-have for those working from home who want to streamline their finances and keep every allowable dollar in their pocket.

Explore our comprehensive

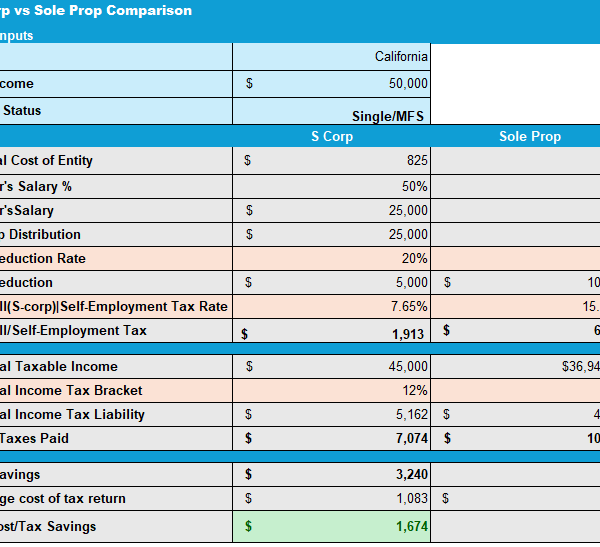

Easily compare the financ

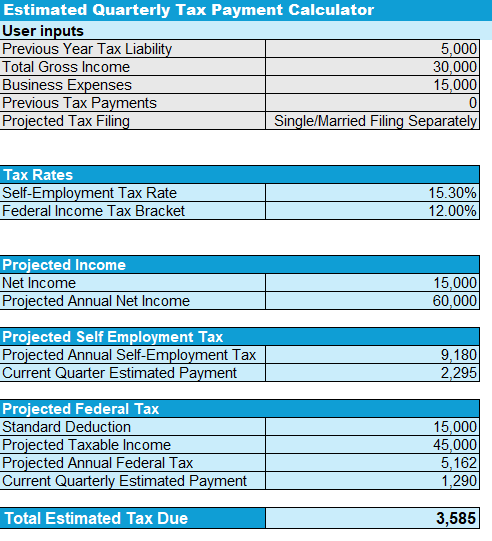

Stay on top of your taxes