$4.99

Take the stress out of calculating asset depreciation with our Depreciation Calculator Spreadsheet. Built for solopreneurs and freelancers, this powerful tool calculates your asset’s depreciable basis, allows for Section 179 deductions, and gives you clear monthly straight-line depreciation expenses. Track expenses, optimize deductions, and simplify tax prep—without the headaches.

As a solopreneur or freelancer, staying on top of your finances is critical—but asset depreciation can be tricky to manage on your own. Enter our Depreciation Calculator Spreadsheet, a comprehensive tool designed to make depreciation simple, accurate, and automated. This spreadsheet calculates your asset’s depreciable basis and provides you the option to apply Section 179 deductions, giving you maximum control over upfront expenses to strategically optimize your tax savings.

Once your assets are entered, the spreadsheet seamlessly calculates monthly straight-line depreciation expenses, helping you track each asset’s value over time with zero hassle. You can focus on building your business while this tool keeps your depreciation numbers ready for tax season. Whether you’re managing equipment, office furniture, or vehicles, this spreadsheet is your complete solution for tracking, optimizing, and managing asset deductions. Eliminate guesswork, simplify bookkeeping, and gain a clearer picture of your financials—all in one easy-to-use tool.

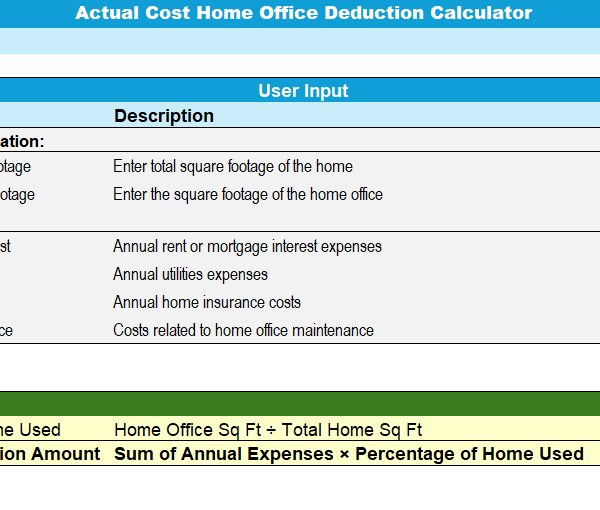

Easily calculate your hom

Explore our comprehensive