$4.99

Optimize your tax deductions with our Standard Mileage vs. Actual Cost Deduction Calculator! Designed for solopreneurs and freelancers, this spreadsheet helps you accurately log and calculate vehicle expenses, ensuring you maximize your deduction while simplifying your record-keeping. Save time and take control of your tax deductions with ease!

Take the guesswork out of your vehicle tax deductions with the Standard Mileage vs. Actual Cost Deduction Calculator! This Business Mileage Log & Deduction Calculator is tailored for content site owners and online entrepreneurs who frequently travel for business purposes, whether it’s for networking, attending conferences, or meeting clients. This tool simplifies the complex task of tracking business mileage by allowing users to choose between the standard mileage rate and actual cost methods, ensuring they capture the maximum allowable deduction. For digital business owners who may be unfamiliar with managing travel expenses, this tool provides a user-friendly, accurate way to log each trip, calculate deductions, and maintain organized records—all critical for tax compliance and maximizing savings.

With easy-to-use input fields for logging mileage, fuel, maintenance, and other vehicle expenses, the spreadsheet automatically calculates your potential deduction under both the Standard Mileage and Actual Expenses methods. This way, you can see at a glance which method maximizes your deduction, saving you both time and money.

Forget complicated calculations and missed deductions! This calculator not only helps you keep organized and compliant but also empowers you to make tax-efficient decisions without the hassle. Whether you’re just starting out or a seasoned business owner, streamline your tax prep with the tool that gives you the confidence to get every mile and dollar working for you.

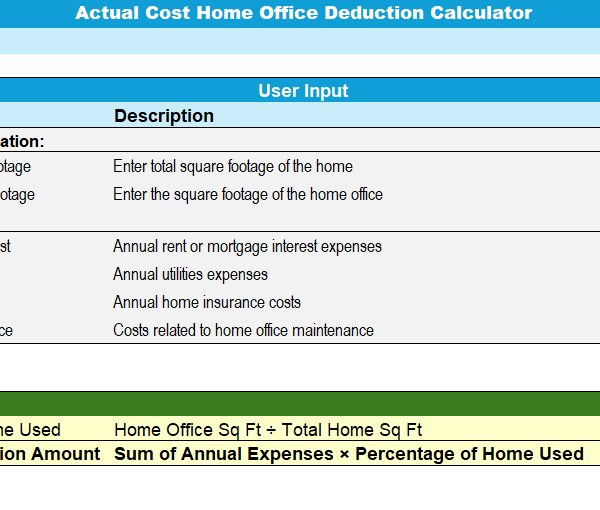

Take the stress out of ca

Easily calculate your hom

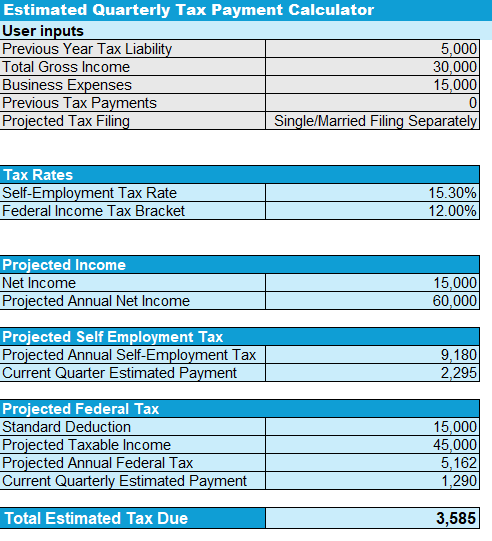

Stay on top of your taxes